- InvestSC Newsletter

- Posts

- InvestSC's Catalytic Chronicles: 2025 Mid-Year Momentum

InvestSC's Catalytic Chronicles: 2025 Mid-Year Momentum

Your Insight into South Carolina's Venture Capital Journey

Join us for a quick read to discover how and where we’re deploying SSBCI capital across South Carolina. Learn about the founders driving innovation, the impact we’re catalyzing, and the latest updates on our investment journey!

#InvestSC

South Carolina was awarded $101 million through the State Small Business Credit Initiative (SSBCI) program. InvestSC was then formed by the South Carolina Jobs-Economic Development Authority (JEDA) to serve as the Designated Investor Group for South Carolina. Our mission is to stimulate the economy of South Carolina through matching capital investments of accredited investors.

As the premier equity program of South Carolina, we’re responsible for deploying $51 million via equity investments in locally headquartered startups. Our sister program is responsible for deploying the remaining $50 million via a Loan Participation Program.

Not only do we make direct equity investments, but we’re also actively seeking emerging fund managers who align with our vision for South Carolina-based investments, where we can participate as a limited partner (LP).

InvestSC By the Numbers:

Direct Investment Capital Deployed: $4.1M since April 2024

Direct Investment Capital Committed: $4.15M in Pipeline

Fund Investment Capital Committed: $5M

Number of Founders Supported: 9

Industries Invested In: CPG, AI, SaaS platforms including FinTech, Logistics and Healthcare, and Digital Health Services (and looking to expand!)

Meet the Innovator

Celebrating the visionaries driving innovation in our portfolio.

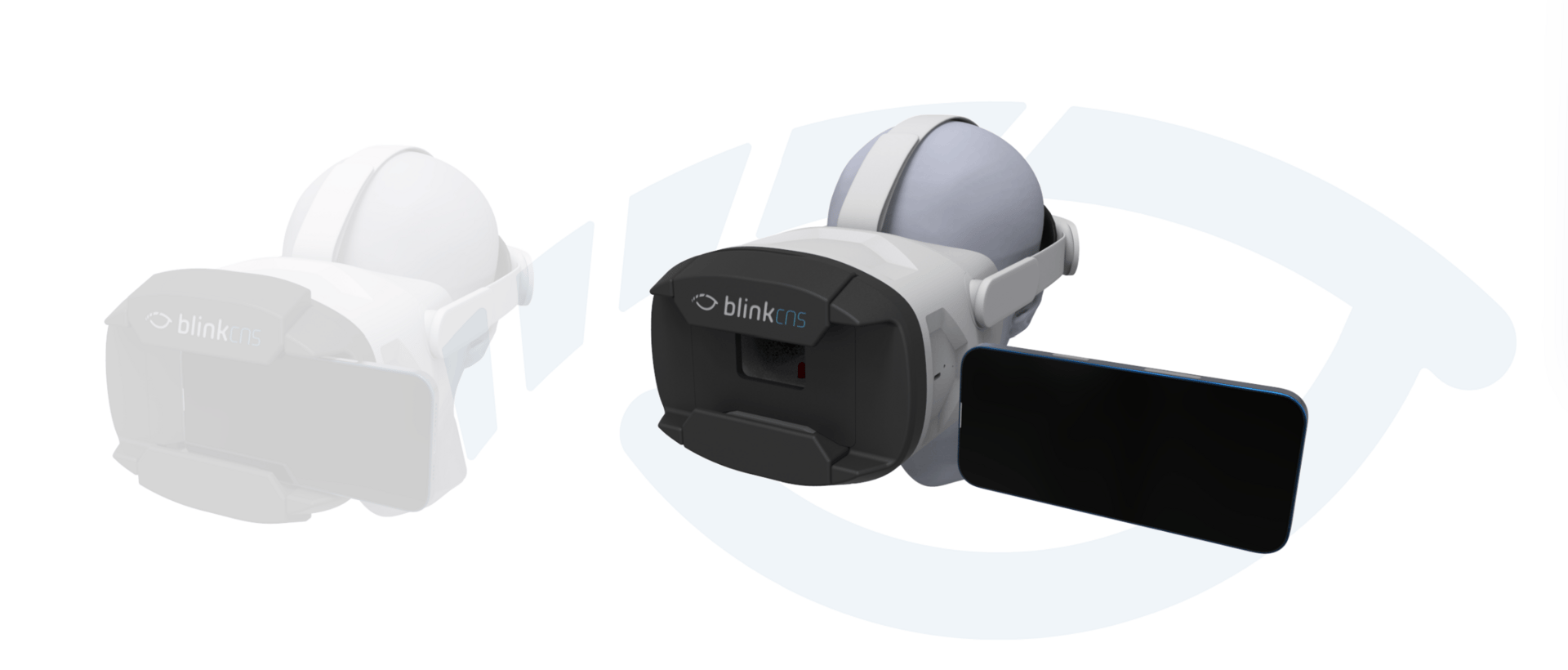

Ryan Fiorini \ CEO of Blinkcns

“Having InvestSC as an investor—rooted in our state and committed to innovation—has been invaluable. Their support is accelerating our ability to scale, expand access, and redefine what’s possible in brain health.”

Dr. Ryan Fiorini is the founder and CEO of Blinkcns, a pioneering neurotechnology company redefining how we diagnose and monitor brain health. With a background spanning molecular biology, immunology, and biotech entrepreneurship, Ryan has spent his career bridging science and innovation to solve some of healthcare’s toughest challenges. The idea for Blinkcns was born from a simple but powerful observation: the blink reflex—a split-second, involuntary response—can reveal critical insights about the brain. Under Ryan’s leadership, Blinkcns developed EyeStat, a patented, FDA-cleared medical device that measures blink reflexes to help clinicians rapidly assess neurological function in under a minute, non-invasively and without relying on patient self-report.

Since its inception, Blinkcns has focused on transforming neurological care—particularly in military, sports, and pediatric populations—where fast, objective data can change outcomes. The EyeStat platform is now being used across the U.S. in clinical trials and point- of-care settings, delivering new insights into concussions, traumatic brain injury, and degenerative neurological diseases.

Ryan and his team are on a mission to empower clinicians with smart, scalable tools that bring transparency and objectivity to brain health—starting with the blink. Blinkcns combines deep scientific rigor with a clear commercial vision, ensuring that innovation is both impactful and accessible.

With this raise, Ryan is able to push the newest iteration of their device through FDA approval

Latest Ventures Backed by InvestSC:

Here’s where our capital is directly fueling innovation and growth most recently.

Company | Location | Funding Round | Website |

|---|---|---|---|

Precision Genetics | Greenville | Series B | |

White Leaf Provisions | Mt. Pleasant | Series A | |

GoodUnited | Charleston | Seed + | |

VBASE Oil Company | Pendleton | Seed | |

LevelFields | North Charleston | Seed | |

Darby | Greenville | Seed Extension | |

Blinkcns | Charleston | Series C | |

Revaly dba CADchat | Columbia | Seed Bridge | |

Strata Platforms | Greenville | Seed Extension |

Portfolio Announcements:

White Leaf Provisions has officially earned a spot on the 2025 Inc. 5000 list, recognizing the fastest-growing private companies in America. The company also ranked 67th in the state for food and beverage companies and 14th in Charleston.

Are you a founder based in South Carolina looking for funding to grow your business?

InvestSC’s Direct Investment Program provides the matched capital and support you need to scale your vision. Be sure to check out our FAQ guide for qualifications.

Driving Health Innovation Through Partnership:

MUSC Health and InvestSC Launch New Venture Fund to Fuel Health Innovation in South Carolina

The South Carolina Health Innovation Fund is a $10 million complementary fund made possible through a strategic partnership between MUSC Health and InvestSC, the state’s Small Business Credit Initiative (SSBCI) administrator. SCHIF is focused on high-impact health innovation companies - both from within and outside MUSC - that are committed to growing and operating in South Carolina.

By partnering with these funds, we’re able to:

Accelerates development of health solutions: By funding high-impact health innovation companies, SCHIF helps bring new treatments, technologies, and care models to market faster.

Drives collaboration: Encourages partnerships between startups, academic researchers (especially at MUSC), and the healthcare system.

Stimulates job creation: By investing in early- to growth-stage health companies, SCHIF fosters new job opportunities in biotech, medtech, digital health, and related sectors across South Carolina.

Emerging Fund Managers - Interested in Partnering with Us?

If you manage a fund aligned with InvestSC’s mission and are interested in collaboration, we’d love to hear from you! Be sure to check out our FAQ guide for qualifications.

Strengthening SC’s Venture Ecosystem—Together.

Through partnerships with local investor groups, we're creating a stronger foundation for innovation, growth, and opportunity in South Carolina.

“Your investment is more than just capital — it’s a sign to the broader venture community that visionary, high-growth companies can succeed in the Southeast, and that South Carolina is serious about supporting them.”

“Our collaboration with InvestSC not only enhances our deal flow but also de-risks CAP investments through strategic matching. We're proud to partner in a way that amplifies impact and drives sustainable growth across our portfolios.”

“InvestSC has been a great partner with SC Launch Inc as we have co-invested in several companies over the last few months. We look forward to continuing this relationship in the future.”